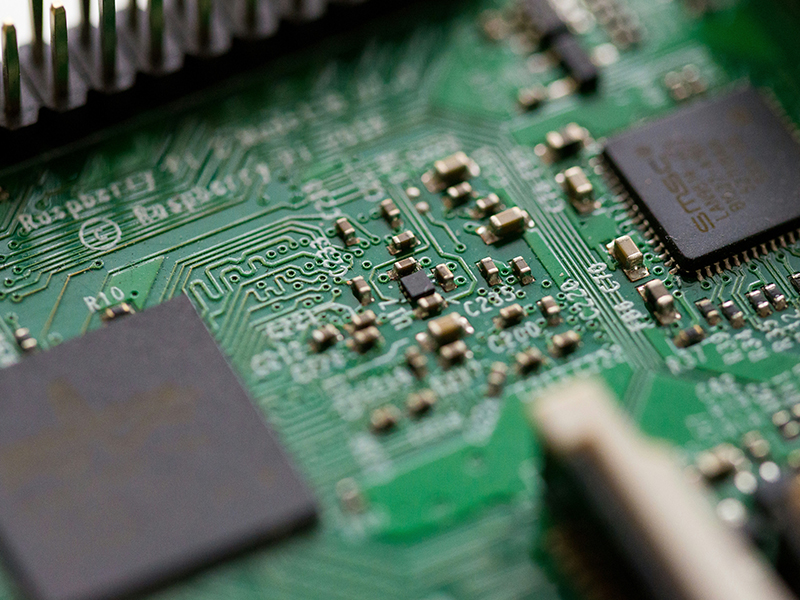

Market Trends/Semiconductors, PCBs, and heavy electronics, please pay attention

United News Network

June 16, 2024

Author Economic Daily/Zeng Yanyu (Vice President of Qunyi Investment Consulting)

June 16, 2024

Author Economic Daily/Zeng Yanyu (Vice President of Qunyi Investment Consulting)

Market potential analysis

Apple launched "Apple Intelligence" at the Worldwide Developers Conference (WWDC) last week, officially entering the field of AI and cooperating with OpenAI. iPhone 15 Pro and products equipped with M series chips can run ChatGPT4.0. The market expects a renewed wave of iPhone replacements.

Apple's stock price surged last week, brushing aside concerns over its reliance on the mainland market for slowing sales growth. Apple's biggest advantage is its huge potential market and big data, which can train its own large-scale training model (LLM). The news released by WWDC this time is not so much that the powerful AI function drives a wave of phone replacement, but that Apple fans have waited for three years and finally found a replacement. The reason for the machine.

The battle for market value between Microsoft, NVIDIA and Apple is not over yet, and the key may lie with TSMC. TSMC’s largest customer is Apple, and Huida is actively competing for production capacity, and customers are lining up to continue competing for favor. TSMC is not only the protector of the country, but also the world’s king of AI arms.

After the Taiwan stock index reached a new high, technology stocks have become more volatile. You can pay attention to the performance space of non-electricity groups. The cash flow of the construction group is stable, and the construction value lies in the interest of land development in stock. There is not much problem on the demand side. The central bank has taken control to limit the loan ratio, which is in line with market expectations. And blue-chip construction stocks have become constituent stocks of high-dividend ETFs. Investment trust has started in the second quarter. Increase holdings in construction stocks.

Investment Advice

In the past, TSMC (2330) rose sharply and pushed the index to open higher, which generally resulted in the emergence of profit selling pressure, so it was ridiculed as "accumulation". Recently, the market has gradually adapted to "accumulation" and begun to make healthy adjustments, at least not Blindly panic, but first observe those that will rise and those that will fall. Semiconductor stocks and AI stocks are more willing to take over at low prices. It is recommended to continue to pay attention to the rotation of strong stocks. Short-term operation targets include AI stocks, IC design, Apple supply chain, PCB, heavy electricity, shipping, and construction stocks.

Related links: https://udn.com/news/story/7251/8034748

【Disclaimer】

The content of this article only represents the author's personal views and has nothing to do with Creating.

The content, textual description and originality have not been confirmed by this website. This website does not make any guarantee or commitment for this article and all or part of its content, authenticity, completeness and timeliness. It is for readers' reference only. Please verify the relevant content by yourself.

Creating Nano Technologies, Inc.

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com