PCB manufacturers are expanding their factories to seize AI business opportunities; experts reveal key layouts

Business Times

January 4, 2025

Author: Financial Weekly Text/Hong Baoshan

January 4, 2025

Author: Financial Weekly Text/Hong Baoshan

AI Chunjiangshuinuan PCB Prophet! TSMC Chairman Wei Zhejia called on supply chain partners to seize the great business opportunities of AI and prepare to double production capacity within three years. PCB factories have been expanding frequently recently, so please pay attention to when the growth momentum of related stocks will explode.

TSMC dominates the world in advanced processes. The demand for artificial intelligence (AI) has driven TSMC's advanced processes and advanced packaging capacity to become popular. At the recent TSMC Supply Chain Management Forum, Wei Zhejia hoped that supply chain partners would seize the AI business opportunities together and declared that partners were invited to We are preparing to double our production capacity within three years. The market estimates that TSMC's capital expenditure in 2025 will reach US$38 billion, surpassing US$36.25 billion in 2022, setting a new record high.

CoWoS advanced packaging is still in short supply

On December 31, 2024, it was reported that TSMC's advanced process price was raised in 2025 due to the fact that TSMC's manufacturing costs in the United States are at least 30% higher than those in Taiwan. Taking into account multiple factors such as the policies of US President-elect Trump, higher production costs, and the shortage of advanced process capacity, TSMC raised its advanced process price in 2025. The range could be around 5% to 10%, or it could be through a price increase of around 3% and the cancellation of discounts.

AI drives the CoWoS advanced packaging to continue to be in short supply in 2025. Semiconductor equipment manufacturers including JDT, Hongsu, Mason, Hongkang, Zhisheng, Xinyun, and Hiwin will continue to benefit from the strong demand for CoWoS packaging equipment in 2025. , the growth of the above-mentioned stocks can be clearly seen from the profit figures. HiSilicon's profit was halved in 2023, and its after-tax EPS in the first three quarters of 2024 was 4.65 yuan. It should be able to exceed 5.75 yuan in 2023 and return to growth in 2025.

Jingcheng Technology merges with Japanese company to seize AI business opportunities

On December 26, it was reported that Jincheng Technology decided to acquire 100% of the shares of Japanese PCB manufacturing company Lincstech for 39.7 billion yen (equivalent to NT$8.4 billion). This company focuses on high-end PCB products, including multi-layer circuit boards ( MWB), probe cards for high-end DRAM testing, and high-density multi-layer boards (MLBs) for high-speed applications such as 400Gbps switches in data centers. It is clear that Huaxin Group also wants to grab AI hardware. Upgrade opportunities. In the past three years, the earnings per share of Jingcheng Technology have remained between 5 and 6 yuan. The after-tax EPS in the first three quarters of 2024 was 4.96 yuan. After the completion of the acquisition in 2025, profits are expected to grow significantly.

Qun Yi issued bonds to build a factory, Dehong expanded production for the second time

Since 2023, the PCB industry has been constantly reporting news of fundraising and expansion. For example, in 2021, Xunde handled private placements to introduce Jiadeng to strengthen its semiconductor layout. In 2023, AOI equipment manufacturer Maktec handled private placements to introduce ASE to invest 2.167 billion yuan to obtain With a 23.1% stake in MuDe, it has become the largest corporate shareholder of MuDe. In 2023, the after-tax EPS of Mudtech declined from 13.35 yuan to 8.21 yuan, and the after-tax EPS in the first three quarters of 2024 was 2.61 yuan.

In 2024, Qun Yi will issue domestic convertible corporate bonds with a maximum limit of 1.25 billion yuan. The funds will be used to purchase land and build new factories, as well as spend 602 million yuan to acquire nearly 3,000 square meters of land for production expansion. Liance processed a cash capital increase of 3.5 million shares, approximately RMB 210 million. Taiding-KY now increases the price by 40 yuan and 30 million shares, and Taiding now increases by 1.04 billion yuan.

In response to the upgrading of application technologies such as AI servers and HPC, Dehong's consumption of quartz glass fiber yarn and cloth continues to rise. The company has started a second expansion of its Suzhou plant in China to meet the incremental market demand in 2025. As the demand for high speed and high frequency develops towards 400G and 800G, the number of layers will also increase with the application. The demand will triple in 2025, and the capital expenditure will reach 1 billion yuan. After the expansion, the production capacity will increase by about 30%. Gaoji's after-tax EPS in the first three quarters of 2024 is 2.5 yuan, which is expected to decline from 5.07 yuan in 2023.

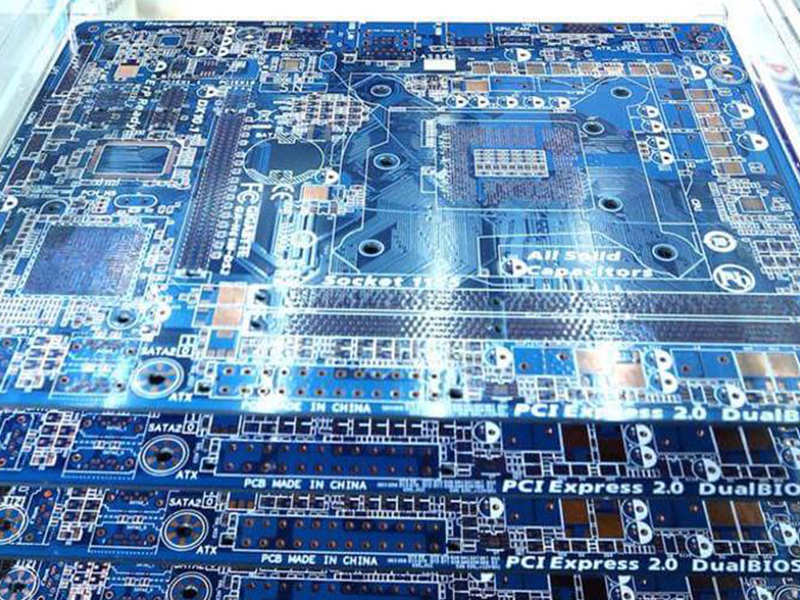

Why are so many PCB manufacturers expanding production? Printed circuit boards are used in various electronic products such as communications, computers, semiconductors, and automobiles. Electronic components such as chips, capacitors, resistors, connectors, etc. must be installed and joined on the PCB to form PCBA (Printed Circuit Board Assembly). In order to integrate and function, the Taiwan Printed Circuit Association (TPCA) analyzed that 2024 is seen as the beginning of the development of AI to the edge. The improvement of edge performance will reduce dependence on the cloud.

Entering TSMC's supply chain, profits speak for themselves

As AI Edge specifications improve in 2025, more circuit board manufacturers will benefit, and the easing of inflationary pressure will drive global consumer spending to be better than in 2024. AI has driven the semiconductor industry to rapidly develop towards advanced processes. PCB equipment manufacturers have also found new growth momentum and have entered the semiconductor-related fields. Chi Sheng, Da Liang, Qun Yi, and You Tian have all successfully positioned themselves in the semiconductor market and entered TSMC. Supply chain. In the past three years, the after-tax EPS of Qun Yi has exceeded NT$10. The after-tax EPS of Dazhuo and Youtian have declined significantly in the past two years. The after-tax EPS of Zhisheng has remained stable at NT$3-4. It is not clear that entering TSMC's supply chain has had any impact on profits. Obvious contribution.

Taiwan has the world's largest PCB industry chain. Although the proportion of manufacturing in China is still more than 60%, with the gradual opening of new production capacity in Southeast Asia in 2025, geopolitical risks are expected to be reduced. Currently, Dingying and Taihong in Thailand have announced that they have entered mass production. Zhen Ding-KY's Thailand plant is expected to start trial production in the first half of 2025 and enter the mass production stage.

Huatong buys industrial land in Thailand to build low-orbit satellite

Huatong has received orders from four major low-orbit satellite (LEO) companies and will purchase approximately 180,000 square meters of land in the Asia Industrial Park in Thailand in 2023. TPCA believes that the global circuit board production scale of Taiwanese companies will continue to grow at a rate of 5.7% in 2025. Expansion, the total output value will reach 854.1 billion yuan.

Jingcheng Technology pointed out that the world is facing geopolitical challenges. At the same time, the U.S. General Services Administration (GSA) purchases products for the U.S. government and often carries out government procurement activities in accordance with the provisions of the U.S. Trade Agreements Act (TAA). Lincstech's manufacturing base in Singapore will further expand Lincstech's presence in Southeast Asia and provide customers with more solutions in the face of geopolitical challenges.

※Disclaimer: The individual stocks and funds mentioned in the article are for reference only and are not investment advice. Investors should make independent judgments, carefully assess risks, and be responsible for their own profits and losses.

Related link: https://www.ctee.com.tw/news/20250104700011-430502

【Disclaimer】

The content of this article only represents the author’s personal views and has nothing to do with Creating.

The content, text and originality have not been verified by this website. This website does not make any guarantee or commitment to this article and all or part of its content, authenticity, completeness, or timeliness. It is for readers' reference only. Please verify the relevant content on your own.

Creating Nano Technologies, Inc.

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com