DRAM surges PCB supply chain bullish

Yahoo! News

September 25, 2023

Author Li Shuhui

September 25, 2023

Author Li Shuhui

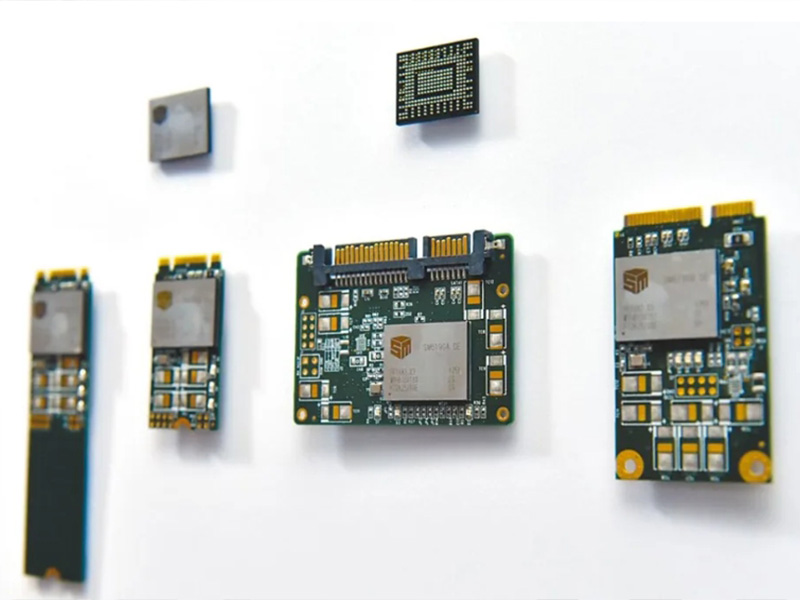

Samsung, a major memory manufacturer, continues to reduce production, and downstream customers are replenishing inventory. The prices of DRAM and NAND Flash are expected to rise in the next quarter, which will drive the memory-related PCB supply chain to stabilize and rebound. PCB downstream applications are in automobiles, AI After the server remains strong and supported, the fourth quarter is expected to add a new force of memory recovery.

Domestic memory module boards are mainly supplied by Jianding, Xinxing, and Jingguo; while BT carrier boards are mainly used in memories and mobile phones. South Korea is a major memory and mobile phone manufacturer, accounting for the largest market share of BT carrier boards in the world. In the first half of 2023, Samsung Electro-Mechanics, LG, and Simmtech ranked in the top three, while Xinxing and Jingshuo ranked fourth and fifth, with market shares of 7.3% and 6.9% respectively. Related companies are all expected to recover from the memory industry beneficiary.

In the first quarter of this year, Samsung's DRAM and NAND Flash market share reached 42.8% and 34.3%, both ranking first in the world. Samsung's production cuts initiated in response to market conditions have affected global supply and demand. As inventory digestion has come to an end, downstream customers are worried about the original The factory has raised chip prices and started a wave of inventory replenishment. In addition, as terminal demand has not fully recovered, Samsung will continue to reduce production. Currently, SSD chips are already in short supply. Agents believe that although this wave of recovery is not due to the rebound in terminal demand. However, given Samsung’s dominant position, continued production cuts will balance supply and demand, and prices of both DRAM and NAND Flash may rise in the fourth quarter.

There are not many new manufacturers of memory module boards, and the competition situation is relatively stable. When Jingguo held a press conference a few days ago, it was revealed that the order intake of memory module boards has stabilized. Currently, this application accounts for about 25.7% of Jingguo's revenue. %, being the largest application; Jianding’s memory module board revenue accounted for 19.5% in the second quarter, second only to the company’s automotive board application.

The economy was weak in the first half of this year. Among the downstream applications of PCB, only automobiles and AI servers had relatively strong demand. Smartphones were not driven by new models from Apple and Huawei until the third quarter, and demand improved slightly. Analysts then named memory , China Netcom's inventory digestion is coming to an end, and the two major applications are expected to continue to enter the recovery ranks.

PCB manufacturers have different paces of recovery. However, as the first half of the year is relatively low compared to the base period, the performance of the second half of the year is expected to be better than the first half of the year. Judging from the revenue in the first two months of the third quarter, the legal persons named Jianding, Taiwan Optoelectronics, and Huatong It is expected to reach the high target of the legal person's estimated value.

Related links: https://tw.news.yahoo.com/dram%E5%96%8A%E6%BC%B2-pcb%E4%BE%9B%E6%87%89%E9%8F%88%E7 %9C%8B%E6%97%BA-201000579.html?guccounter=1

【Disclaimer】

The content of this article only represents the author's personal views and has nothing to do with Kuiding.

The content, textual description and originality have not been confirmed by this website. This website does not make any guarantee or commitment for this article and all or part of its content, authenticity, completeness and timeliness. It is for readers' reference only. Please verify the relevant content by yourself.

The content of this article only represents the author's personal views and has nothing to do with Kuiding.

The content, textual description and originality have not been confirmed by this website. This website does not make any guarantee or commitment for this article and all or part of its content, authenticity, completeness and timeliness. It is for readers' reference only. Please verify the relevant content by yourself.

Creating Nano Technologies,Inc.

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com